The IRS Form 1099 serves as a crucial document for independent contractors, freelancers, and other non-employee workers in the US. Applicable to various categories of self-employment income, the most widely encountered version is the 1099-MISC form. This document is utilized by businesses to report payments made to independent contractors during the tax year, with the amounts exceeding $600. As a vital element of the taxation process, possessing an in-depth understanding of the 1099 employee form printable is imperative for both companies and service providers alike.

For those seeking comprehensive guidance on this topic, the website 1099-form-us.com offers an unparalleled resource. Containing free printable 1099 tax form templates alongside detailed instructions, the site empowers users to navigate the complexities of the document with ease. Furthermore, the inclusion of real-life examples facilitates a deeper knowledge of how to fill in Form 1099-MISC most effectively. Boasting a wealth of materials, 1099-form-us.com significantly streamlines the form-completion process, providing valuable support for businesses and independent contractors throughout the United States.

IRS Form 1099 & Obligated Taxpayers

If you are an independent contractor or a payer, you may find yourself in need of a 1099 form. Users can easily access a free 1099 form in PDF format on our website, streamlining the tax filing process. It is important for businesses and individuals to understand who needs to fill out the 1099 form for an independent contractor and be aware of certain exemptions.

IRS 1099 Tax Form: Exempted Contractors

Exemptions for filling and filing the 1099 form include the following:

- Payments to corporations (unless an exception applies)

- Payments made for merchandise, telegrams, telephone, freight, or storage

- Payments of rent to real estate agents

- Wage payments to employees and certain payments to fishermen

Remember to review each exemption carefully and maintain accurate records throughout the year. You can also file the 1099 form online to ensure your tax filing process goes smoothly and you comply with IRS regulations. More examples and solutions are available at the 1099misc-form-online.com website.

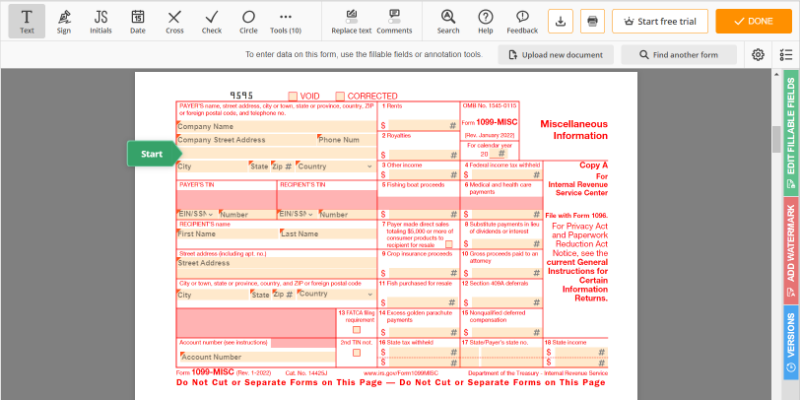

Blank 1099-MISC Income Tax Form: Basic Rules to Fill It Out

- Begin by visiting our website and locating the blank 1099 tax form you need to complete.

- Click on the appropriate IRS Form 1099 template to open it and familiarize yourself with the format.

- Enter your basic information, such as your name, address, and Taxpayer Identification Number (TIN).

- Carefully fill in additional required details, including the payer's details and income received.

- Double-check all the information to ensure it's accurate and error-free.

- After filling out the required fields, proceed to print the 1099 form template directly from our website.

- Verify and sign the printed example, then distribute copies to the IRS, payee, and any necessary state agencies.

- Keep a copy for your records, and enjoy a hassle-free tax season using our user-friendly tools.

Due Date to File Federal 1099 Tax Form

The deadline for submitting Form 1099-MISC for 2022 is January 31. This particular due date is established as it sets a clear timeline for businesses and individuals to report miscellaneous income for the previous calendar year.

Although the deadline for filing the IRS 1099 tax form printable seems firm, situations may arise where individuals require more time. While it is possible to request an extension, it's important to note that approval is not guaranteed. When considering an extension, carefully assess the possible advantages and disadvantages, taking into account potential late filing penalties.

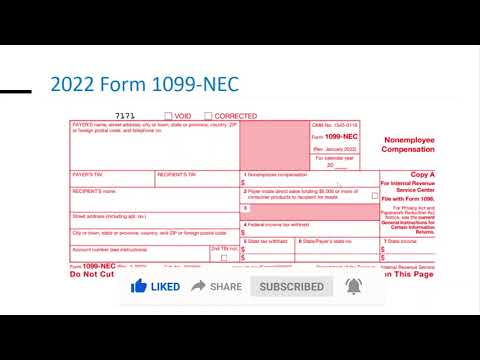

Printable 1099 Form for 2022

Printable 1099 Form for 2022

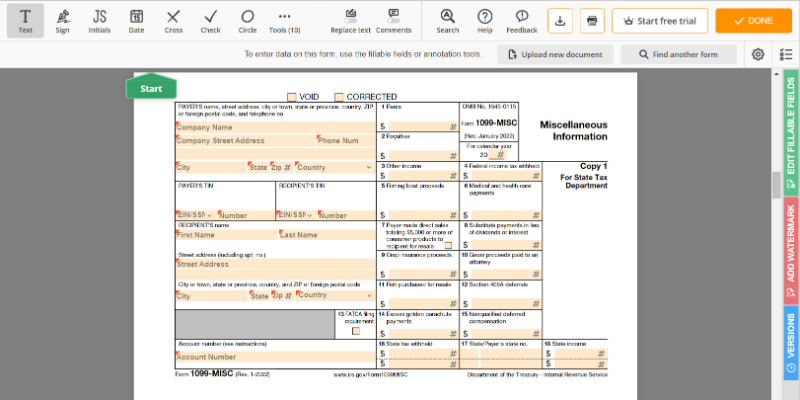

Online 1099-MISC Form

Online 1099-MISC Form

IRS Form 1099 Instructions

IRS Form 1099 Instructions

Online Form 1099

Online Form 1099

Printable 1099 Form

Printable 1099 Form